Enhance your space with top-quality tiles, granite, and stone solutions.

Perfect for homes, offices, and commercial spaces.

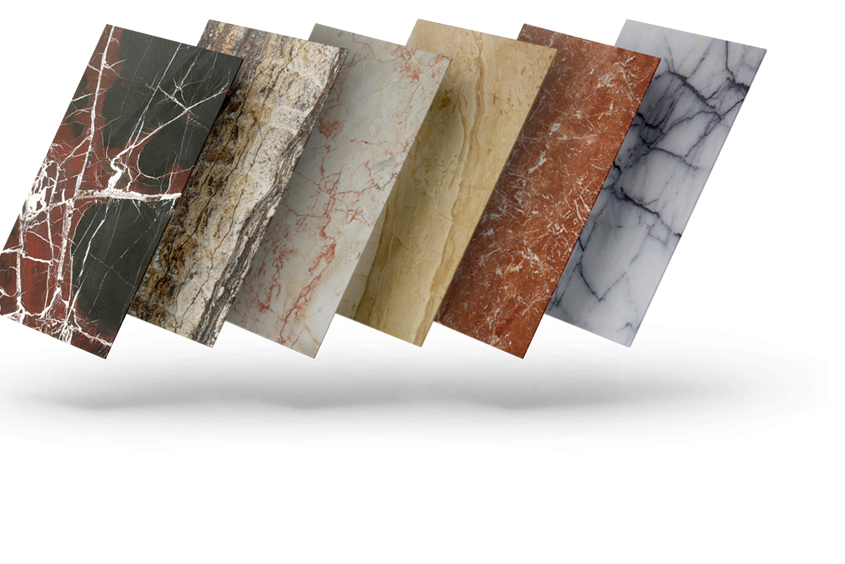

LARGEST TILES & MARBLES STOCKIST IN UAE

TIMELESS ELEGANCE FOR EVERY PROJECT

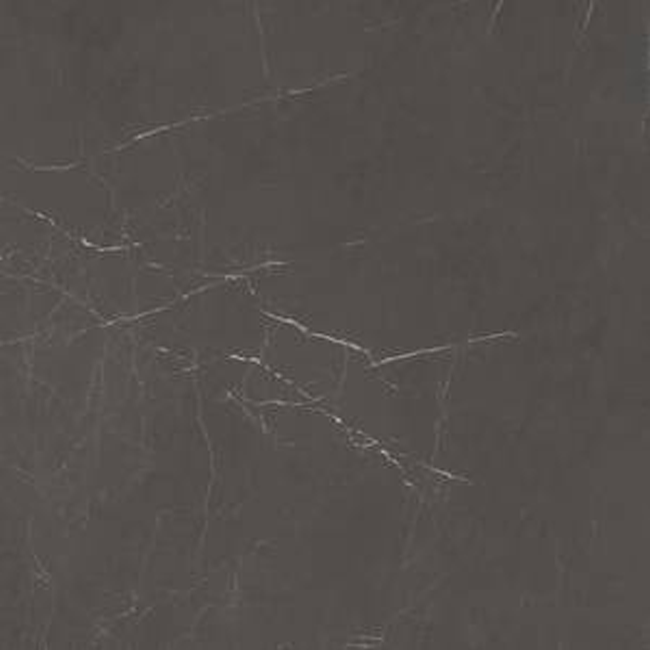

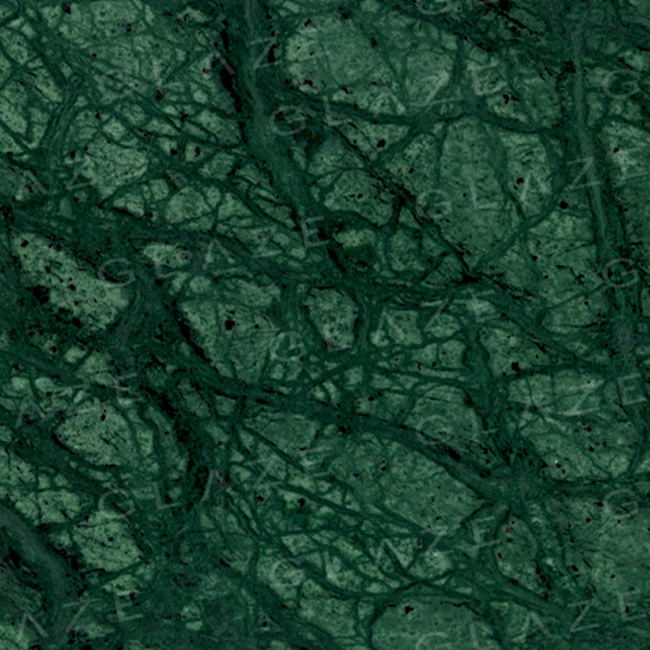

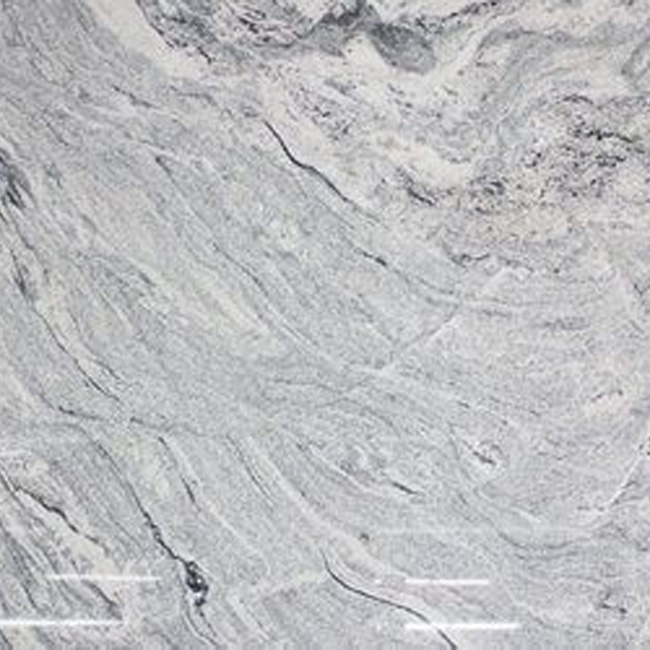

Discover high-quality ceramic, porcelain, and natural stone tiles

designed for durability and style

designed for durability and style

QUALITY MATERIALS, EXCEPTIONAL DESIGNS

From modern interiors to classic aesthetics,

we offer the perfect surface solutions for every need.

we offer the perfect surface solutions for every need.